Note: This blog was modified 4/6/20 with an updated encryption reference. Cloud video conferencing adoption has gone mainstream, with 42.9% of organizations with more than 2,500 now using it, according to Nemertes’ recent study of visual communications and collaboration among more than 500 companies. Adoption among financial services organizations is even higher, with 52.2% now using cloud video conferencing as an alternative to on-premise platforms. Cloud video conferencing makes it easy for any organization to quickly deploy high-quality, feature-rich services to all employees and meeting spaces without having to invest in large, upfront capital expenditures. The flexibility of the cloud enables companies to buy only what they need, when they need it, and easily expand deployments as necessary. It also provides fast access to emerging features like high-definition, wideband audio, and AI features that speed meeting startup, enable the real-time capture of meeting notes and action items, and translate among different native-language speaking participants. In the financial services sector, organizations are increasingly adopting video conferencing to enhance customer-facing interactions. Examples include enabling portfolio managers, loan officers, and insurance representatives to engage with customers visually, leading to higher-quality experiences, increased up-sale, and improved customer satisfaction. Almost 23% of financial services organizations using video conferencing have identified productivity gains as well, thanks to the ability of video to enhance meeting experiences.  Another factor driving video conferencing adoption is employee demand. Fifty-eight percent of financial services IT leaders cite “user demand” as their primary driver for expanding video conferencing deployments. The growing adoption of video conferencing in the consumer space is increasing the comfort level with video and creating a video-first generation that has always known video as a primary means of communication. Buyers tend to look for the following capabilities when evaluating competing video conferencing services:

Another factor driving video conferencing adoption is employee demand. Fifty-eight percent of financial services IT leaders cite “user demand” as their primary driver for expanding video conferencing deployments. The growing adoption of video conferencing in the consumer space is increasing the comfort level with video and creating a video-first generation that has always known video as a primary means of communication. Buyers tend to look for the following capabilities when evaluating competing video conferencing services:

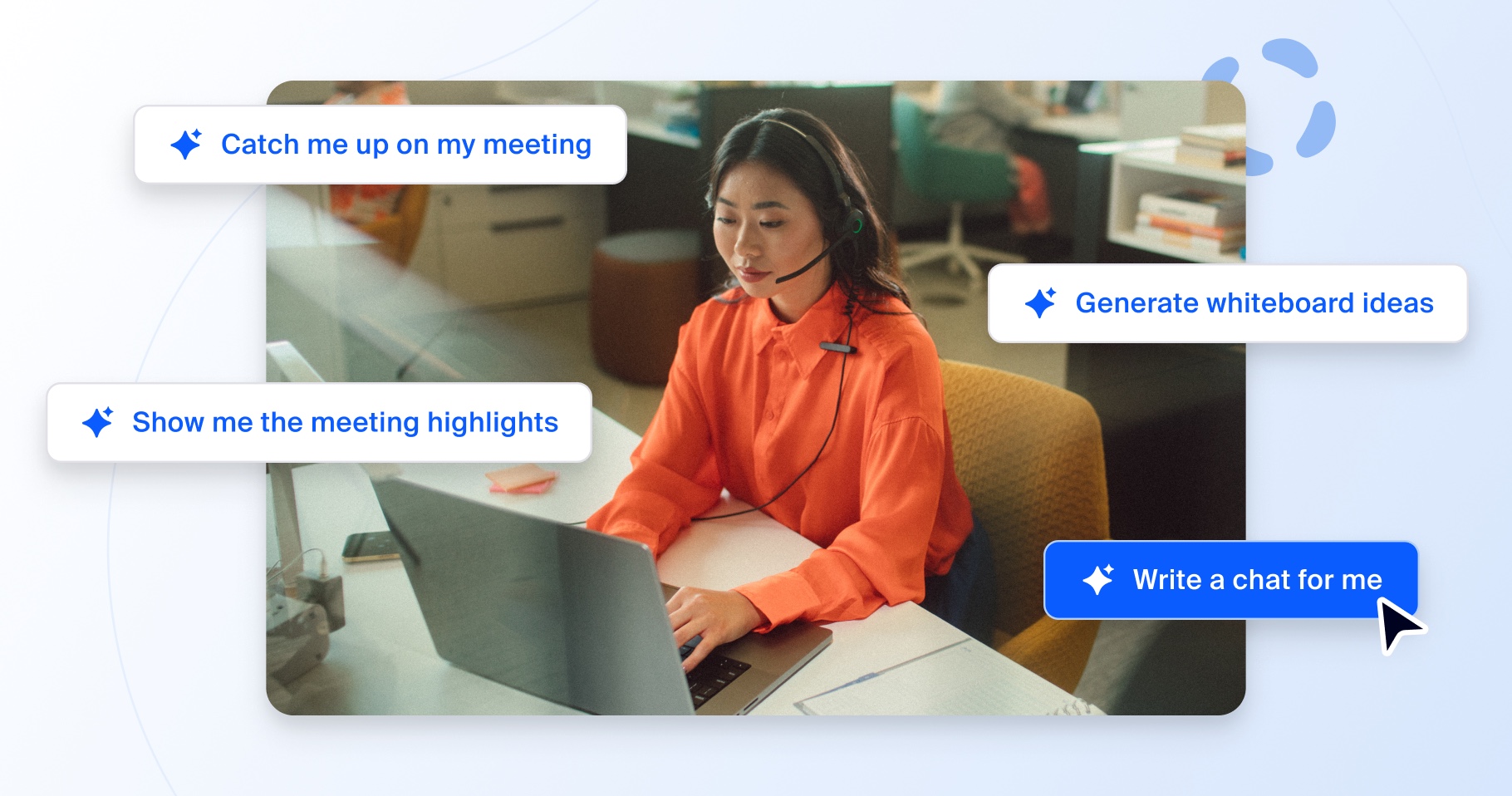

- Consistency of experience: Using a provider that supports a unified meeting experience across desktops and rooms of all sizes through a common set of interfaces correlates with the lowest operational cost, highest utilization, and greatest productivity gains.

- High-quality audio and video: High-definition and wideband audio are increasingly the norm for video-enabled meetings.

- Ease of use: Applications should be intuitive and should allow for users to quickly engage with one another.

- Fast start-time and join: Ideally, the time it takes for a person to start or join a meeting should take no more than a few seconds.

- Calendar integration: Employees should be able to easily schedule, launch, and manage meetings through their existing calendar app.

- Team app integration: With companies increasingly adopting team apps like Microsoft Teams and Slack, integration of meeting apps into team spaces is essential to ensure that employees don’t have to switch apps to meet.

- Global support: Among our research participants who operate globally, the ability for participants to easily join a meeting from anywhere in the world is essential for success.

- Compliance and security: Financial services organizations require security features like encryption in transit, the ability to control access to meetings and recordings, single sign-on, and support for role-based security models. Buyers will typically look for security certifications, including SOC 2 Type 2.

Beyond picking the right cloud video conferencing provider, the key to success is driving adoption. Only 34.7% of financial services firms have implemented a formal program to encourage video usage. Easy-to-use, high-quality services will typically see viral adoption as employees quickly realize the benefits of engaging with one another via video. However, in organizations where a video-first culture does not yet exist, our research finds that direct training as well as encouraging management to use the app strongly correlate with high adoption. Financial services leaders should look to the cloud for their video needs. Doing so positions the organization to reap the benefits of video in the form of improved internal and external engagement while minimizing costs and gaining faster access to emerging features. Consider leading-edge providers that support your feature, integration, and security needs, and consider establishing an initial training program to drive adoption and utilization.

Another factor driving video conferencing adoption is employee demand. Fifty-eight percent of financial services IT leaders cite “user demand” as their primary driver for expanding video conferencing deployments. The growing adoption of video conferencing in the consumer space is increasing the comfort level with video and creating a video-first generation that has always known video as a primary means of communication. Buyers tend to look for the following capabilities when evaluating competing video conferencing services:

Another factor driving video conferencing adoption is employee demand. Fifty-eight percent of financial services IT leaders cite “user demand” as their primary driver for expanding video conferencing deployments. The growing adoption of video conferencing in the consumer space is increasing the comfort level with video and creating a video-first generation that has always known video as a primary means of communication. Buyers tend to look for the following capabilities when evaluating competing video conferencing services: